Wipro Q4 Results: Wipro said its IT services segment revenue cam in at $2,657.4 million for the quarter, up 0.1 per cent QoQ and down 6.4 epr cent YoY. Its constant currency (CC) IT Services segment revenue fell 0.3 per cent QoQ and 6.6 per cent YoY.

Wipro Q4 results highlights: Profit falls 8% to Rs 2,858 crore, sales down 4%

IT major Wipro Ltd on Friday reported a 7.60 per cent year-on-year (YoY) drop in consolidated net profit at Rs 2,858.20 crore compared with Rs 3,093.50 crore in the same quarter last year. The consolidated revenue from operations fell 4.23 per cent YoY to Rs 22,208.30 crore compared with Rs 23,190.30 crore in the same quarter last year. Anlaysts were expecting a 4-8 per cent drop in profit and a 4-5 per cent drop in sales.

Wipro said its IT services segment revenue came in at $2,657.4 million for the quarter, up 0.1 per cent QoQ and down 6.4 per cent YoY. Its constant currency (CC) IT Services segment revenue fell 0.3 per cent QoQ and 6.6 per cent YoY.

Deal wins, margin, attrition

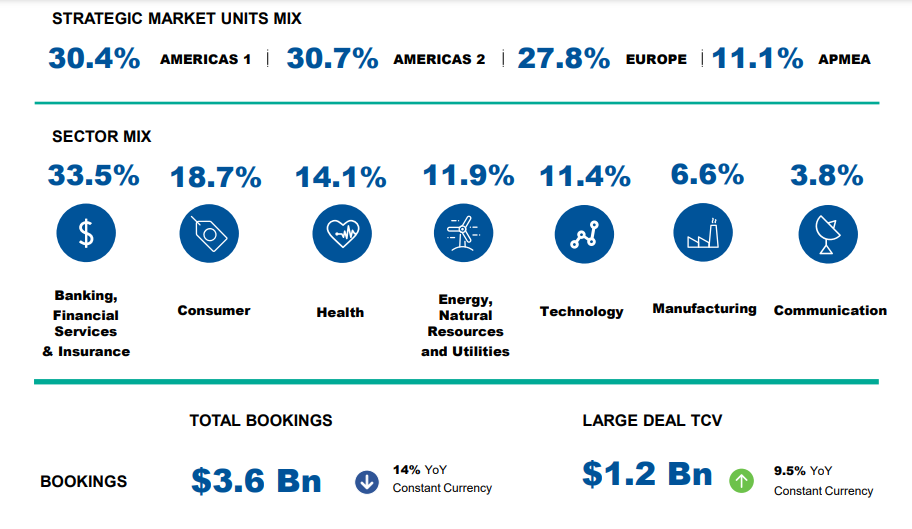

Total deal wins stood at $3.6 billion. Large deal bookings came in at $1.2 billion, up 31.1 per cent QoQ and 9.5 per cent YoY. IT services operating margin for the quarter stood at 16.4 per cent, up 40 bps QoQ. Chief Financial Officer Aparna Iyer said: “We expanded our margins by 40 basis points during the quarter resulting in EPS growth of 5.2 per cent QoQ in Q4. Despite a challenging macro-environment our IT services margin expanded by 50 basis points for the full year FY24. We generated highest operating cash flow in recent years which is at 183 per cent of our net- income in Q4 and 159% on a full year basis.”

Voluntary attrition stood at 14.2 per cent on a trailing 12-month basis.

Wipro Q1FY25 (June quarter) outlook

Wipro said it expects revenue from IT Services business segment to be in the range of $2,617 million to $2,670 million. This translates to sequential guidance of (minus) 1.5 per cent to a growth of 0.5 per cent in constant currency

terms.

Wipro management commentary

New CEO and Managing Director Srini Pallia said: “FY24 proved to be a challenging year for our industry, and the macroeconomic environment remains uncertain. However, I am optimistic about the opportunities that lie ahead. We are on the brink of a major technological shift. Artificial intelligence is transforming our clients’ needs as they seek to harness its power for competitive advantage and enhanced business value. At Wipro, we have been gearing up for this moment,” he said.

Wipro capital Allocation

The Board of Directors confirmed the interim dividend of Re 1 declared by the board earlier at its meeting held on January 12th, 2024, shall be considered as the final dividend for the financial year 2023-24.

Wipro appointments

In another filing, Wipro said its board approved the re-appointment of Rishad A. Premji as Whole-Time Director designated as Executive Chairman for a period of 5 years with effect from July 31, 2024 to July 30, 2029.

The board alos re-appointed Azim H. Premji as Non-Executive, Non-Independent Director for a period of 5 years with effect from July 31, 2024 to July 30, 2029.

Disclaimer: rojgarlive Business Today provides stock market news for informational purposes only and should not be construed as investment advice. Readers are encouraged to consult with a qualified financial advisor before making any investment decisions.