Nifty has turned cheaper but is offset by repeated inclusion of growth stocks that are inherently expensive such as Britannia, Nestle India, Titan and Tata Consumer.

Recent Nifty exclusions included IndianOil, GAIL Ltd, Indus Towers Ltd, Zee Entertainment, Vedanta, HPCL and Aurobindo Pharma, among others.

ICICI Securities in a recent note said that Nifty has seen inclusion of significantly ‘expensive’ stocks since FY18, which has optically inflated index valuations. The trend of inclusion of expensive growth stocks may continue, it said.

In April 24 note, ICICI Securities argued that Nifty50 index P/E on a trailing basis rose to 23 times today from 22 times in FY18. However, if the same set of companies that existed in the index in FY18 had continued to stay in the index, the P/E ratio would have contracted to 20.9 times, which is at a discount of 9 per cent to the current index P/E.

“The above indicates that on a like-to-like basis, the index has turned cheaper but is offset by repeated inclusion of low-volatility growth stocks that are inherently expensive (Britannia, Nestle, Titan, Tata Consumer, Divi’s Lab, Apollo Hospitals, HDFC Life, Bajaj Finserv, etc.),” the domestic brokerage said.

ICICI Securities said that the median P/E of inclusion stocks at the time of index change was 60 times, which was 6 times the median P/E of exclusion stocks that stood at 10 times. The excluded stocks included IndianOil, GAIL Ltd, Indus Towers Ltd, Zee Entertainment, Vedanta, HPCL and Aurobindo Pharma, among others.

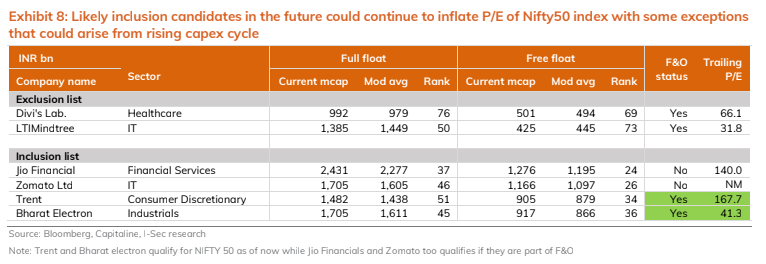

The next in line stocks that can be included in the index as per their high free float market cap include Jio Financial Services Ltd, Zomato Ltd, Trent Ltd and Bharat Electronics Ltd, which ICICI Securities said are significantly expensive growth stocks against index valuations.

“However, Jio Financial and Zomato are not yet part of the F&O list, while Trent and Bharat Electronics (BEL) will need to qualify on free float market cap criteria for the relevant period (Feb – Jul’24),” the broking firm said.

Disclaimer: rojgarlive Business Today provides stock market news for informational purposes only and should not be construed as investment advice. Readers are encouraged to consult with a qualified financial advisor before making any investment decisions.