As per the annual report, the number of folios reached an all-time high of 17.78 crore. The investor base expanded to approximately 4.46 crore, with women constituting approximately 23% and men around 77% of investors.

The percentage gain of over 35% in FY24 was the highest since fiscal 2021 when the industry had grown 41%.

The Assets Under Management (AUM) managed by domestic mutual funds (MFs) grew by 35 per cent during 2023-24 (FY24), the highest since FY2021, to a new high of Rs 53.40 lakh crore as of March 2024 compared with Rs 39.42 lakh crore as of March 2023, AMFI annual data stated. As per the numbers shared, the assets surged by nearly Rs 14 lakh crore in the last fiscal.

The percentage gain of over 35% was the highest since fiscal 2021 when the industry had grown 41%. The surge, along with a significant rise in the number of investors, highlights a fundamental change in investor behavior and market dynamics.

As per the annual report, the number of folios reached an all-time high of 17.78 crore. The investor base expanded to approximately 4.46 crore, with women constituting approximately 23% and men around 77% of investors.

The recently completed fiscal year 2024 denotes the 12th successive year of AUM growth for the industry largely focused on serving retail investors. This sector last observed a decline in annual AUM during the fiscal year 2011-12. Despite significant advancements, the mutual fund industry’s AUM comprises approximately just one-quarter of total bank deposits.

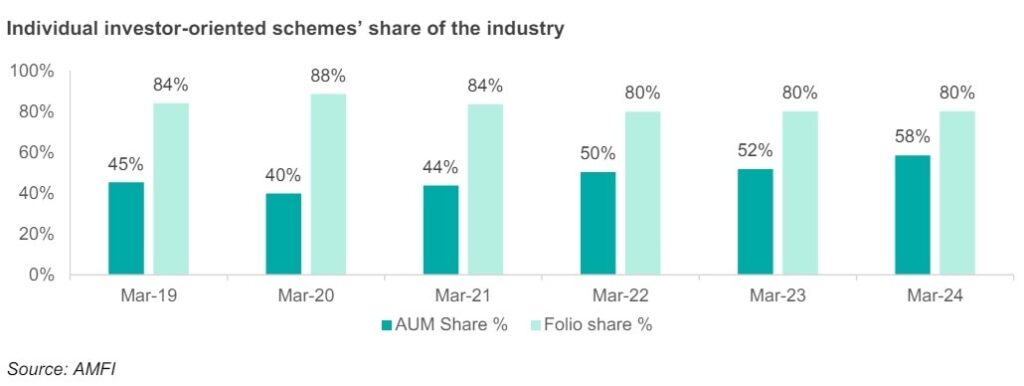

The report said individual investors dominated mutual fund categories such as equity, hybrid and solution-oriented schemes, and led the growth chart as households in the country increased their capital market participation through the mutual fund route. The three categories together accounted for nearly 58% of the industry assets and 80% of the folio count as of March 2024; share of assets of these categories has increased from 45% in March 2019, showcasing their dominance in the growth of industry assets.

The share of assets of these categories has increased from 45% in March 2019 to 58% in March 2024. The folio share has declined from 84% in March 2019 to 80% in March 2024.

Equity MFs

Equity-oriented mutual fund categories grew 55% in fiscal 2024 to Rs 23.50 lakh crore, led by strong inflows and MTM gains. The category saw net inflows of Rs 1.84 lakh crore in the fiscal, up from Rs 1.47 lakh crore in the previous fiscal.

The broad category also benefitted from sharp growth in the underlying equity markets, leading to MTM gains in industry assets. Equity markets represented by Nifty 50 total return index (TRI) and Nifty 500 TRI gained ~33% and ~44%, respectively, during the fiscal.

Flexi cap category was the largest fund category with assets of over Rs 3.50 lakh crore as of March 2024, followed by large cap funds with Rs 3.14 lakh crore assets. In terms of percentage growth, multi cap fund category saw the highest growth of 85% in fiscal 2024, followed by small cap funds at 82%.

Passive funds

Passive funds continued to see growth in assets; the segment continued to benefit from institutional investment flows into exchange traded funds (ETFs) from investors such as provident funds. ETFs as a category have assets of Rs 6.64 lakh crore as of March 2024. The category also saw inflows of Rs 42,000 crore in the fiscal compared with inflows of ~Rs 61,000 crore for the entire passive funds category.

Debt funds

Debt funds saw a moderate growth of around 7% in fiscal 2024 to close with assets of Rs 12.62 lakh crore, after contracting 2% and 9% in fiscals 2022 and 2023, respectively.

The category also gained in folios, albeit small number of over 5,000 folios in fiscal 2024, after degrowth in the previous two fiscals, as investors retained confidence in the segment, despite the removal of indexation benefit.

In terms of asset growth, money market and liquid funds saw the highest absolute asset gain of Rs 40,000 crore and Rs 31,000 crore respectively. Money market funds also saw the second highest percentage growth in the fiscal year of 37%.

Among other categories, long duration funds saw the highest percentage growth at 45% to close with assets of Rs 12,700 crore. Overnight funds (down 36%) were the biggest drag in the debt mutual fund category during the year.

SIP contribution

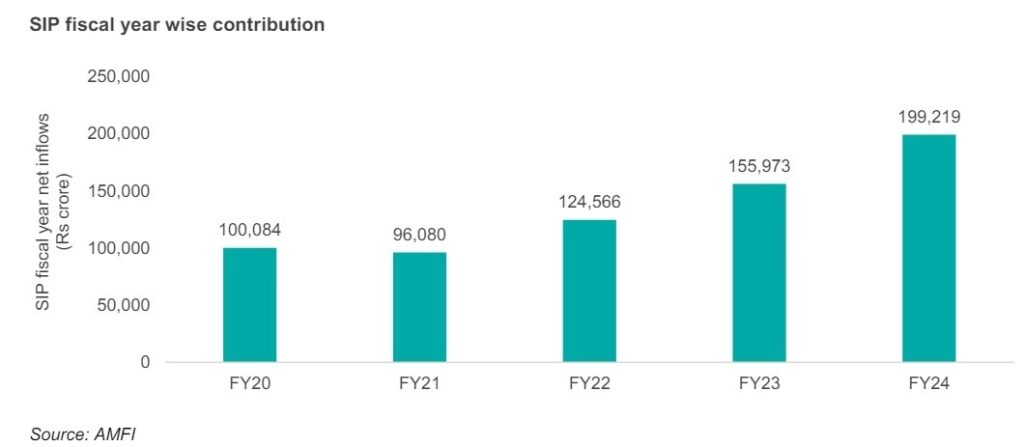

Investor adoption of systematic investment plans (SIPs) continues to rise with monthly net inflows at ~Rs 19,300 crore in March 2024. For fiscal year 2024, the net inflows through SIPs stood at nearly Rs 2 lakh crore versus Rs 1.55 lakh crore in the previous fiscal year.

SIP assets stood Rs 10.71 lakh crore as of March 2024, accounting for over 20% of the industry assets. Further, the number of SIP accounts reached nearly 8.4 crore with ~17 lakh accounts added per month.