The third-party application provider license will allow customers to continue using the Paytm app.

The National Payments Corp of India (NPCI) is likely to approve a third-party application provider license for Paytm by March 15.

RBI IS unlikely to extend the deadline of March 15 set for Paytm Payments Bank to wind down its operations, a Reuters report said.

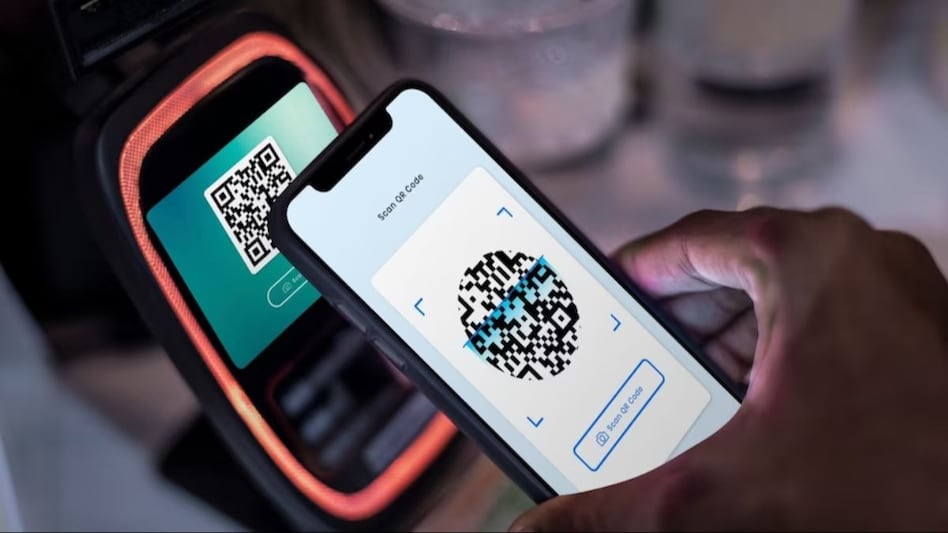

The third-party application provider license will allow customers to continue using the Paytm app to make payments via India’s popular unified payment interface after the banking arm winds down.

A TPAP is a service provider that participates in UPI via PSP bank. A PSP bank, a UPI unit, connects to the UPI platform to provide payment facilities. This will enable end-user customers and merchants to make and accept such payments.

NPCI okays the participation of issuer banks, PSP banks, TPAPs, and prepaid payment instrument issuers (PPIs) in UPI.

On February 23, 2024, the RBI said it had advised the NPCI to examine the request of OCL to become a TPAP for continued UPI operations on Paytm app. This followed the regulator’s instruction to Paytm PB to cease offering services after March 15, 2024.